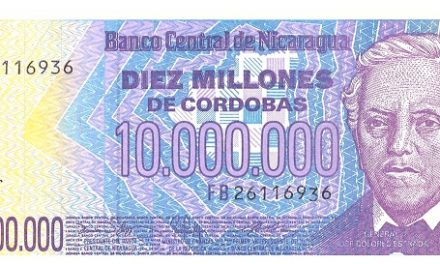

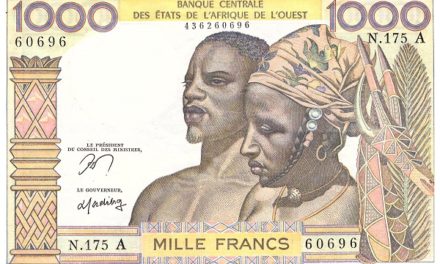

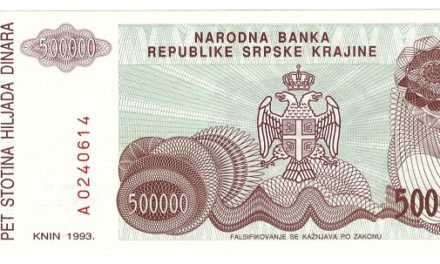

| Continente | País | Año | Denominación | Nº Pick |

The information on the Form W-9 and the payment made are reported on a Form 1099.[44] The second purpose is to help the payee avoid backup withholding. The payer must collect withholding taxes on certain reportable payments for the IRS. Form 1099 series is used to report various types of income other than wages, salaries, and tips (for which Form W-2 is used instead). Examples of reportable transactions are amounts paid to a non-corporate independent contractor for services (in IRS terminology, such payments are nonemployee compensation). • Form 1040 Schedule 1 is the place to report types of income not included on Form 1040, including taxable refunds of state and local income taxes, alimony received, income or loss from a business; rent and royalty income, and more. The Form 990 provides the public with financial information about a nonprofit organization, and is often the only source of such information.

Tax software, like TaxAct, ensures you answers all pertinent questions so you don’t miss out on a single tax credit or deduction available to you. The only time you may notice a difference is when you look at your tax return after it is prepared and printed. Part one contains credits such as the Foreign Tax Credit, the Child Care Credit, education credits, the Retirement Savings Credit, and Residential Energy Credit. These credits are “nonrefundable”, which means that they cannot exceed the amount of income tax you owe for the year (before income tax withholding and other payments are factored in).

About Schedule 8812 (Form , Credits for Qualifying Children and Other Dependents

Previous to 2018, there were different 1040s such as Form 1040A and 1040EZ. https://kelleysbookkeeping.com/bonus-depreciation-regs-are-favorable-for/ Those two forms have been replaced with the compact Form 1040.

These include taxes on self-employment, HSA, net investment income tax, interest related to Form 8621, and many other taxes. Amounts in this section are Irs Schedule 1, 2, And 3 added and transferred to Form 1040. The Form W-7 and related documents are the application for IRS Individual Taxpayer Identification Number (ITIN).

About Schedule C (Form , Profit or Loss from Business (Sole Proprietorship)

This number is used to identify taxpayers who do not qualify for a social security number. Form 1095 series is used to report health care insurance coverage per the individual health insurance mandate of the Affordable Care Act tax provisions. Each 1095 form lists the primary recipient of the insurance policy along with all the individuals covered under it.

The form is not used for U.S. wages and salaries earned by non-resident aliens (in which case Form W-4 is used), or for U.S. freelance (dependent personal services) income (in which case Form 8233 is used). Taxpayer Identification Number unless the U.S. income is dividends or interest from actively traded or similar investments. The IRS released a new version of W-8BEN in February 2014 that required corporations to sign a W-8BEN-E form instead.